529 Login Maryland

529 Login Maryland - Log in with your user id / email. Already registered for online access? Maryland offers a state tax deduction for contributions to a 529 plan of up to $2,500 for single filers and $5,000 for married filing jointly tax filers. Manage your account anywhere, anytime. The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such as financial aid, scholarship funds, and protection from. If this is your first time logging into your account since our transition to the new maryland college investment plan. Check your account balance, transaction history, and investment allocations. Maryland offers the maryland college investment plan to residents of any state. Need a username and password? Secure login portal for my529 account management. Maryland offers a state tax deduction for contributions to a 529 plan of up to $2,500 for single filers and $5,000 for married filing jointly tax filers. College savings plans of maryland is a program available to all maryland residents to assist with saving for college. The maryland prepaid college trust. Check your account balance, transaction history, and investment allocations. Already registered for online access? The maryland 529 plans are the only 529 plans that offer an annual maryland state income subtraction, and any earnings and contributions can be used tax free for eligible qualified. The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such as financial aid, scholarship funds, and protection from. Welcome to the maryland college investment plan account owner portal. Log in with your user id / email. If this is your first time logging into your account since our transition to the new maryland college investment plan. If you are logging on for the first time, you'll need to create a username and password. If this is your first time logging into your account since our transition to the new maryland college investment plan. Welcome to the maryland college investment plan account owner portal. The state in which you or your beneficiary pay taxes or live may. Maryland offers a state tax deduction for contributions to a 529 plan of up to $2,500 for single filers and $5,000 for married filing jointly tax filers. Welcome to the maryland college investment plan account owner portal. Log in with your user id / email. Check your account balance, transaction history, and investment allocations. If you are logging on for. Need a username and password? The maryland senator edward j. Maryland offers a state tax deduction for contributions to a 529 plan of up to $2,500 for single filers and $5,000 for married filing jointly tax filers. Secure login portal for my529 account management. Check your account balance, transaction history, and investment allocations. Already registered for online access? If you are logging on for the first time, you'll need to create a username and password. College savings plans of maryland is a program available to all maryland residents to assist with saving for college. Log in with your user id / email. Maryland offers the maryland college investment plan to residents of any. Already registered for online access? Secure login portal for my529 account management. Maryland offers a state tax deduction for contributions to a 529 plan of up to $2,500 for single filers and $5,000 for married filing jointly tax filers. College savings plans of maryland is a program available to all maryland residents to assist with saving for college. The state. The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such as financial aid, scholarship funds, and protection from. Welcome to the maryland college investment plan account owner portal. Already registered for online access? There are two options available: Check your account balance, transaction history, and. The maryland 529 plans are the only 529 plans that offer an annual maryland state income subtraction, and any earnings and contributions can be used tax free for eligible qualified. If this is your first time logging into your account since our transition to the new maryland college investment plan. Already registered for online access? Welcome to the maryland college. The maryland 529 plans are the only 529 plans that offer an annual maryland state income subtraction, and any earnings and contributions can be used tax free for eligible qualified. Need a username and password? The state in which you or your beneficiary pay taxes or live may offer a 529 plan that provides state tax or other benefits, such. The maryland senator edward j. Maryland offers the maryland college investment plan to residents of any state. If this is your first time logging into your account since our transition to the new maryland college investment plan. Manage your account anywhere, anytime. Secure login portal for my529 account management. Log in with your user id / email. College savings plans of maryland is a program available to all maryland residents to assist with saving for college. Maryland offers the maryland college investment plan to residents of any state. Already registered for online access? Secure login portal for my529 account management. College savings plans of maryland is a program available to all maryland residents to assist with saving for college. Log in with your user id / email. The maryland senator edward j. There are two options available: Already registered for online access? If this is your first time logging into your account since our transition to the new maryland college investment plan. Check your account balance, transaction history, and investment allocations. Maryland offers the maryland college investment plan to residents of any state. The maryland prepaid college trust. Welcome to the maryland college investment plan account owner portal. Maryland offers a state tax deduction for contributions to a 529 plan of up to $2,500 for single filers and $5,000 for married filing jointly tax filers. Need a username and password? If you are logging on for the first time, you'll need to create a username and password.Addressing issues with Maryland 529 YouTube

General Assembly hearing addresses issues with Maryland 529 College Savings Plan

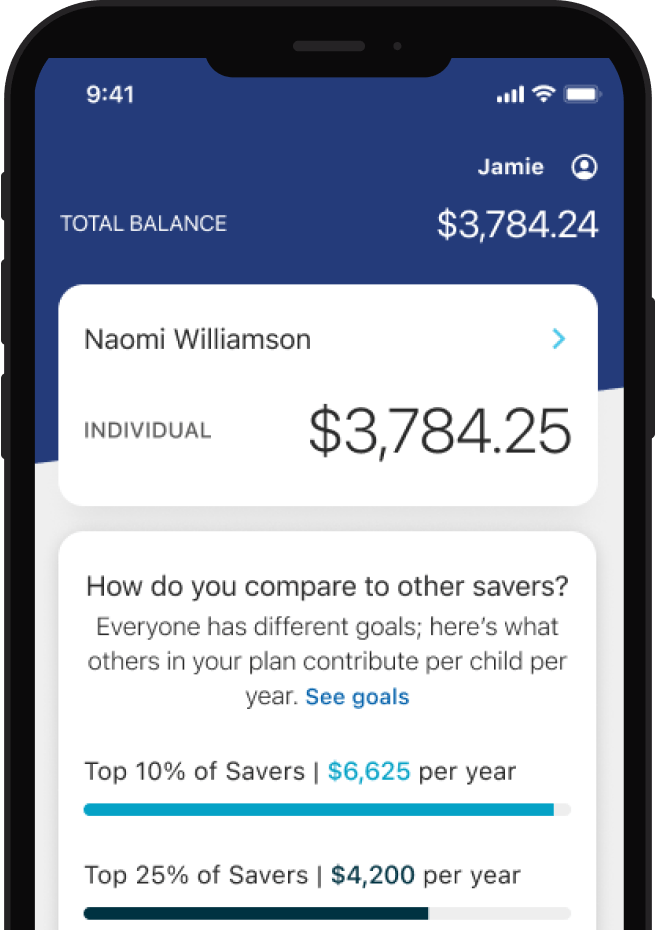

529s make it easier to ask family, friends for college cash Maryland Daily Record

Maryland 529 New Account Enrollment Form Enrollment Form

5 Shocking Md State Refund Myths Debunked

529 Agudath Israel of Maryland

Maryland 529 Plan Compass Advocacy Legal Services in MD

Invest in Their Future with Maryland 529

Maryland 529 plan calculation issue affects hundreds YouTube

Invest in Their Future with Maryland 529

The State In Which You Or Your Beneficiary Pay Taxes Or Live May Offer A 529 Plan That Provides State Tax Or Other Benefits, Such As Financial Aid, Scholarship Funds, And Protection From.

The Maryland 529 Plans Are The Only 529 Plans That Offer An Annual Maryland State Income Subtraction, And Any Earnings And Contributions Can Be Used Tax Free For Eligible Qualified.

Secure Login Portal For My529 Account Management.

Manage Your Account Anywhere, Anytime.

Related Post: