Colorado Springs Sales Tax Login

Colorado Springs Sales Tax Login - Temporary sales tax license application; Logging in new user and connecting to an account. Your browser appears to have cookies disabled. Types of licenses and certificates accessible online. Write the colorado account number (can) for the sales tax account on the check. Cookies are required to use this site. Logging in & connecting to account instructions. Suts is the sales & use tax system from the colorado department of revenue. The city of colorado springs is a 'home rule' city and is authorized to levy and collect its own. Logging in as a new user and connecting to an account for the first time. Support documentation for tax return. Make the check or money order payable to the colorado department of revenue. The city of colorado springs is a 'home rule' city and is authorized to levy and collect its own. Temporary sales tax license application; Current city sales & use tax rate: The city of colorado springs requires businesses to collect and remit sales tax in accordance with local regulations. Exemption from city sales and/or use tax certificate; This means the city is authorized to levy and collect its own sales and use tax. This is a new user. Any person needing access to the account in the online portal must register their email address; The city of colorado springs is home rule. This is a new user. Collecting and remitting sales tax is not only required by law, but it also. Find sales tax rates, forms, payments, and more. Effective 9/1/2023, the city of colorado springs sales tax office will no longer impose a license or renewal fee. Your browser appears to have cookies disabled. If you need assistance, see the faq. Current city sales & use tax rate: The city of colorado springs is a 'home rule' city and is authorized to levy and collect its own. Suts is the sales & use tax system from the colorado department of revenue. Find information about the sales tax rate, sales tax online service, applications, new license list, sales tax exempt organizations, sales tax revenue reports, sales tax amended. Make the check or money order payable to the colorado department of revenue. Logging in new user and connecting to an account. Suts is the sales & use tax system from the colorado department. Cookies are required to use this site. In this tutorial, we guide you through the process of registering as a new user on the sales tax filing and payment portal. The vendor must register and pay the. Find information about the sales tax rate, sales tax online service, applications, new license list, sales tax exempt organizations, sales tax revenue reports,. Find sales tax rates, forms, payments, and more. Collecting and remitting sales tax is not only required by law, but it also. In this tutorial, we guide you through the process of registering as a new user on the sales tax filing and payment portal. Please enter your email address and password to log in. Suts is the sales &. Find information about the sales tax rate, sales tax online service, applications, new license list, sales tax exempt organizations, sales tax revenue reports, sales tax amended. Types of licenses and certificates accessible online. The city of colorado springs is a 'home rule' city and is authorized to levy and collect its own. Use tax only account application; In this tutorial,. The city of colorado springs is home rule. This means the city is authorized to levy and collect its own sales and use tax. Make the check or money order payable to the colorado department of revenue. Sales and use tax system. Support documentation for tax return. Exemption from city sales and/or use tax certificate; For example, if retail sales in colorado were $1,000 per day, starting january 1, 2025, then the retail sales would exceed $20,000 on january 21, 2025. Current city sales & use tax rate: In this tutorial, we guide you through the process of registering as a new user on the sales tax. If you need assistance, see the faq. Suts is the sales & use tax system from the colorado department of revenue. Sales tax collections in colorado springs began the year sluggishly, shrinking slightly compared with the same time last year, according to a report this week from the city’s. Collecting and remitting sales tax is not only required by law,. Support documentation for tax return. Collecting and remitting sales tax is not only required by law, but it also. Sales tax collections in colorado springs began the year sluggishly, shrinking slightly compared with the same time last year, according to a report this week from the city’s. Logging in as a new user and connecting to an account for the. Any person needing access to the account in the online portal must register their email address; Use tax only account application; Collecting and remitting sales tax is not only required by law, but it also. This means the city is authorized to levy and collect its own sales and use tax. Effective 9/1/2023, the city of colorado springs sales tax office will no longer impose a license or renewal fee. For example, if retail sales in colorado were $1,000 per day, starting january 1, 2025, then the retail sales would exceed $20,000 on january 21, 2025. Below is a list of frequently asked questions about city of colorado springs sales and use taxes. Temporary sales tax license application; Current city sales & use tax rate: This is a new user. Find sales tax rates, forms, payments, and more. Please enter your email address and password to log in. Logging in as a new user and connecting to an account for the first time. Suts is the sales & use tax system from the colorado department of revenue. If you need assistance, see the faq. Write the colorado account number (can) for the sales tax account on the check.to the Colorado Sales Tax Lookup YouTube

Businesses Department of Revenue Taxation

Colorado Springs Sales Tax Calculator

2024 Guide to Sales Tax in Colorado Springs, Colorado

How to Login to Colorado Sales Tax Account 2024 Sign In to Colorado Sales Tax Account YouTube

City Of Colorado Springs Sales Tax Catalog Library

colorado springs sales tax 2021 Shelby Rafferty

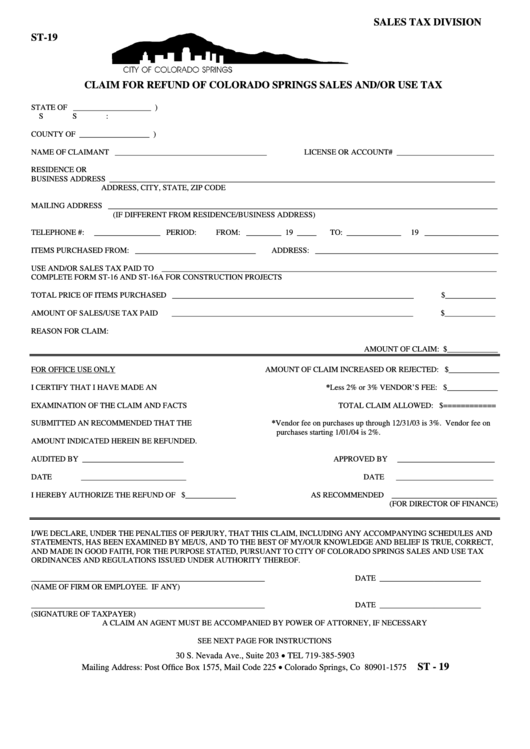

Resale Exemption Certificate City Of Colorado Springs Sales Tax

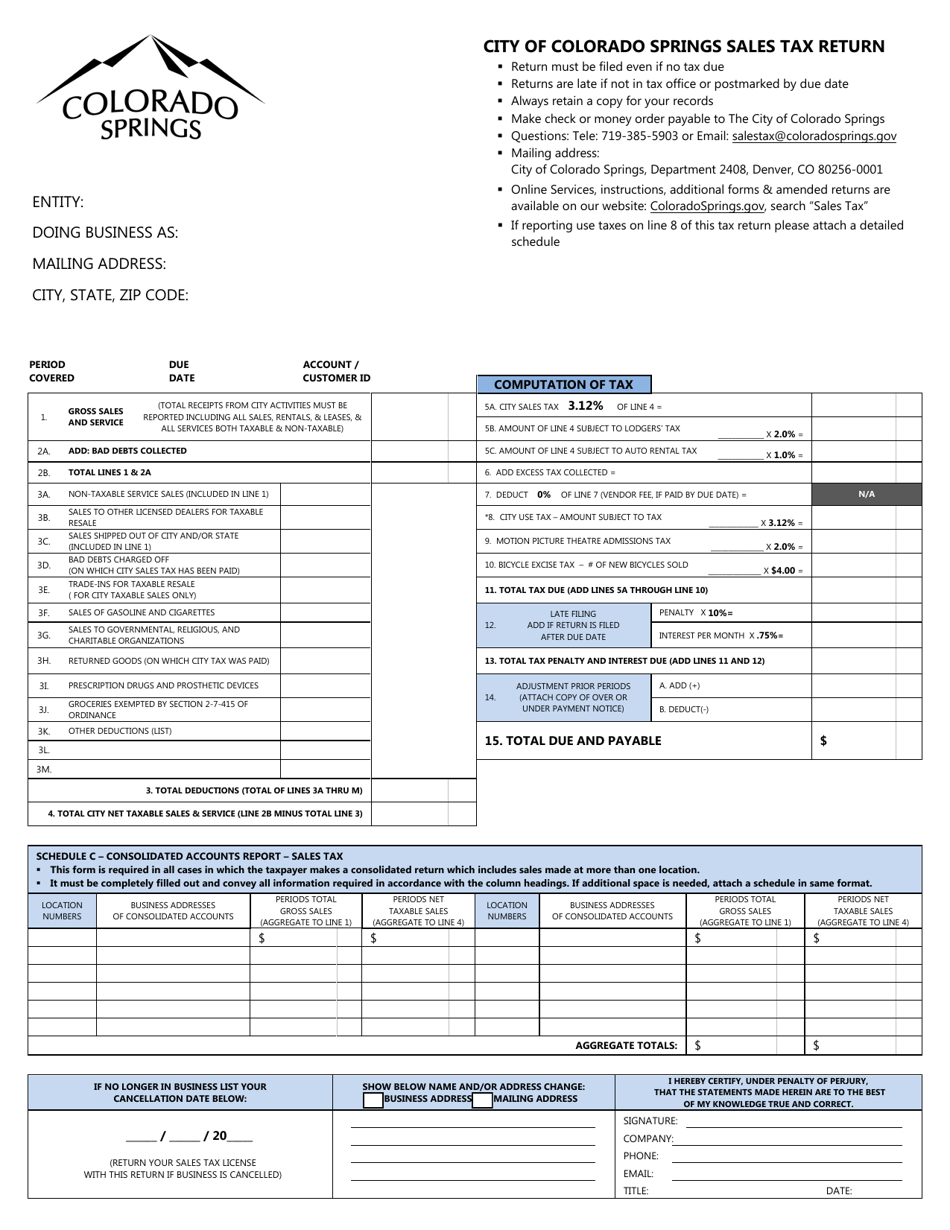

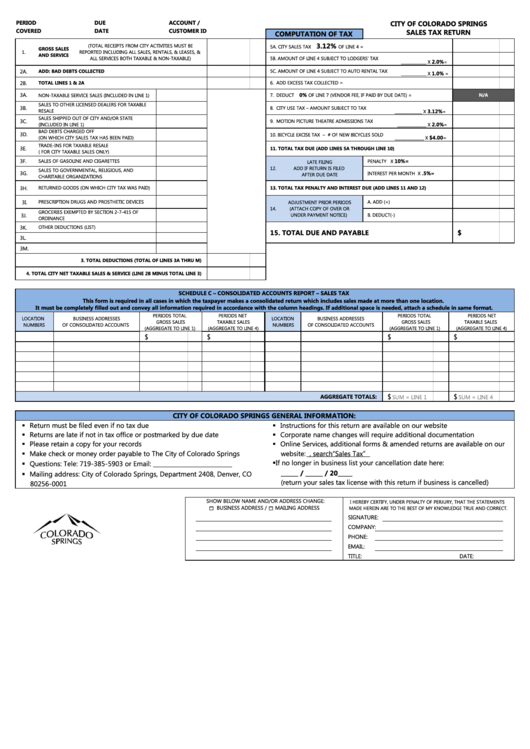

City of Colorado Springs, Colorado 3.12 Sales and Use Tax Return Fill Out, Sign Online and

Sales Tax Return City Of Colorado Springs printable pdf download

The City Of Colorado Springs Is Home Rule.

Your Browser Appears To Have Cookies Disabled.

The Vendor Must Register And Pay The.

Sales And Use Tax System.

Related Post: