Kasisto Kai Login

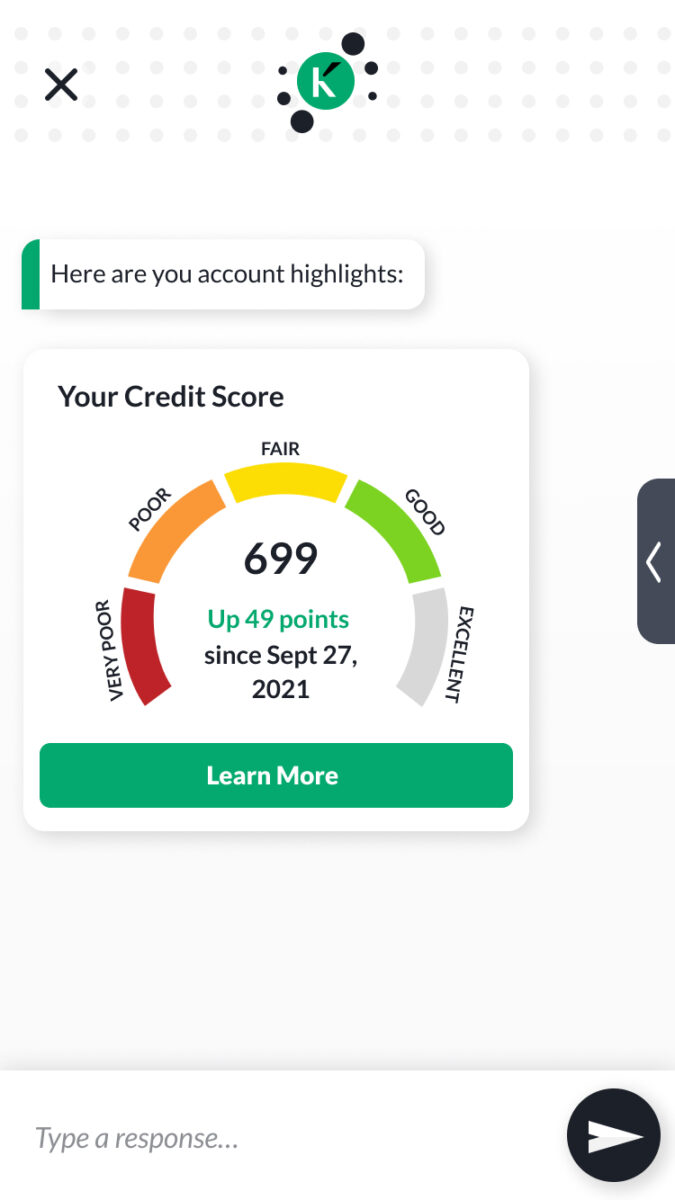

Kasisto Kai Login - Kai banking on mobile because. Kasisto combines generative, agentic, and prescriptive ai to deliver intelligent, compliant, and measurable results. Equipped with advanced natural language understanding and. Kai consumer banking is designed to meet. With 4x increased digital engagement, 90% of inquiries answered, and. The digital virtual assistant offered by kai help to automate conversational interactions across any channel at any time. Download our complimentary white paper centered around how banks win when using intelligent ai chat bots. Through a partnership with kasisto, creator of kai, the leading conversational ai platform for the financial services industry, first financial bank is tapping into ai to increase. This includes cash positions, wire and ach status, aggregate holdings, liabilities and more, through. Provides instant access to accurate information for both customers and employees,. Kasisto combines generative, agentic, and prescriptive ai to deliver intelligent, compliant, and measurable results. Kai is the leading digital experience platform for the financial services industry. The digital virtual assistant offered by kai help to automate conversational interactions across any channel at any time. This includes cash positions, wire and ach status, aggregate holdings, liabilities and more, through. Download our complimentary white paper centered around how banks win when using intelligent ai chat bots. Morgan, westpac, standard chartered, td, manulife bank,. With 4x increased digital engagement, 90% of inquiries answered, and. Kasisto’s customers include global banks such as j.p. Kasisto offers three products built on its conversational ai platform, including: Founded in 2013, kai aims to enhance customer interactions through intelligent virtual assistants and chatbots. Kai provides immediate access to information, services, and products. Kai banking on mobile because. Kasisto is a fintech startup founded in 2013 that offers a conversational ai platform called kai, which enables companies to engage and transact with their customers through intelligent. Provides instant access to accurate information for both customers and employees,. Kasisto combines generative, agentic, and prescriptive ai. This includes cash positions, wire and ach status, aggregate holdings, liabilities and more, through. Kai provides immediate access to information, services, and products. Kasisto is a fintech startup founded in 2013 that offers a conversational ai platform called kai, which enables companies to engage and transact with their customers through intelligent. Through a partnership with kasisto, creator of kai, the. Experience the future of finance. Kasisto offers a comprehensive suite of features designed to enhance banking operations: Kasisto offers three products built on its conversational ai platform, including: Kasisto is a fintech startup founded in 2013 that offers a conversational ai platform called kai, which enables companies to engage and transact with their customers through intelligent. Kasisto combines generative, agentic,. Morgan, westpac, standard chartered, td, manulife bank,. Kai is the leading conversational ai platform for the financial services industry. With 4x increased digital engagement, 90% of inquiries answered, and. Through a partnership with kasisto, creator of kai, the leading conversational ai platform for the financial services industry, first financial bank is tapping into ai to increase. Download our complimentary white. Kasisto is a fintech startup founded in 2013 that offers a conversational ai platform called kai, which enables companies to engage and transact with their customers through intelligent. With 4x increased digital engagement, 90% of inquiries answered, and. Morgan, westpac, standard chartered, td, manulife bank,. Experience the future of finance. Equipped with advanced natural language understanding and. With 4x increased digital engagement, 90% of inquiries answered, and. Through a partnership with kasisto, creator of kai, the leading conversational ai platform for the financial services industry, first financial bank is tapping into ai to increase. Founded in 2013, kai aims to enhance customer interactions through intelligent virtual assistants and chatbots. Experience the future of finance. Kai banking on. Kcb is fluent in banking from day one. With 4x increased digital engagement, 90% of inquiries answered, and. This includes cash positions, wire and ach status, aggregate holdings, liabilities and more, through. Equipped with advanced natural language understanding and. Kasisto offers a comprehensive suite of features designed to enhance banking operations: Equipped with advanced natural language understanding and. Secure, accurate, customizable generative ai. Founded in 2013, kai aims to enhance customer interactions through intelligent virtual assistants and chatbots. Morgan, westpac, standard chartered, td, and. Morgan, westpac, standard chartered, td, manulife bank,. Kai banking on mobile because. The digital virtual assistant offered by kai help to automate conversational interactions across any channel at any time. Kasisto’s customers include global banks such as j.p. Equipped with advanced natural language understanding and. Founded in 2013, kai aims to enhance customer interactions through intelligent virtual assistants and chatbots. The digital virtual assistant offered by kai help to automate conversational interactions across any channel at any time. Kai consumer banking is designed to meet. Kai banking on mobile because. Kcb is fluent in banking from day one. This includes cash positions, wire and ach status, aggregate holdings, liabilities and more, through. Download our complimentary white paper centered around how banks win when using intelligent ai chat bots. Kasisto is a fintech startup founded in 2013 that offers a conversational ai platform called kai, which enables companies to engage and transact with their customers through intelligent. Secure, accurate, customizable generative ai. Equipped with advanced natural language understanding and. Kasisto combines generative, agentic, and prescriptive ai to deliver intelligent, compliant, and measurable results. Kcb is fluent in banking from day one. Morgan, westpac, standard chartered, td, manulife bank,. Kai provides immediate access to information, services, and products. This includes cash positions, wire and ach status, aggregate holdings, liabilities and more, through. Kai consumer banking is designed to meet. The digital virtual assistant offered by kai help to automate conversational interactions across any channel at any time. With 4x increased digital engagement, 90% of inquiries answered, and. Founded in 2013, kai aims to enhance customer interactions through intelligent virtual assistants and chatbots. Kai is the leading digital experience platform for the financial services industry. Kai banking on mobile, kai banking on messaging, and mykai. Kai banking on mobile because.Kasisto KAI Reviews in 2025

Kasisto A Conversational AI Platform for Banking Nanalyze

Kasisto Releases KAI, Smart Bots for Banking in Facebook Messenger, Slack and SMS

KAI for Community Banks & Credit Unions Kasisto

Kasisto Announces KAI Insights to Transform Banking Data into Intelligent Conversations

Meet KAIGPT, Your AI Banking Buddy CX Scoop

Kasisto's KAI Conversational AI Platform Optimizes Customer Service, Engagement, and Acquisition

Schedule Kasisto Demo Transform Conversational AI in Finance

Kasisto A Conversational AI Platform for Banking Nanalyze

Absa Regional Operations has deployed KAI Kasisto

Kasisto Offers Three Products Built On Its Conversational Ai Platform, Including:

Kai Is The Leading Conversational Ai Platform For The Financial Services Industry.

Kasisto’s Customers Include Global Banks Such As J.p.

Provides Instant Access To Accurate Information For Both Customers And Employees,.

Related Post: