Maryland529 Login

Maryland529 Login - A state in which all people,. To stay logged in, select the continue button below. See the plans below to take advantage of the tax deduction available to maryland residents. Decide exactly how you want to save with the maryland college investment plan (also referred to as the college investment plan), managed by t. The maryland 529 plan tax deduction is a maryland state tax deduction you can receive for money you contribute to your maryland 529 college plan (savings and prepaid) in a. Check your account balance, transaction history, and investment allocations. If there is a username for your account, we will send it to this email address. If this is your first time logging into your account since our transition to the new maryland college investment plan. Locating your routing number and your account number. Please enter your username and password. To stay logged in, select the continue button below. A state in which all people,. Manage your account anywhere, anytime. Learn answers to frequently asked questions and see how the plan can help you save for education expenses. Locating your routing number and your account number. Decide exactly how you want to save with the maryland college investment plan (also referred to as the college investment plan), managed by t. The maryland state treasurer, maryland 529, mpct, intuition and their agents do not provide financial, legal or tax advice. Check your account balance, transaction history, and investment allocations. Goldstein treasury building 80 calvert street annapolis, maryland 21401 usa. If there is a username for your account, we will send it to this email address. The maryland 529 plan tax deduction is a maryland state tax deduction you can receive for money you contribute to your maryland 529 college plan (savings and prepaid) in a. If there is a username for your account, we will send it to this email address. The maryland 529 board administers qualified college tuition savings programs created by the u.s.. Rowe price, an investment management firm. The maryland 529 plan tax deduction is a maryland state tax deduction you can receive for money you contribute to your maryland 529 college plan (savings and prepaid) in a. Welcome to the maryland college investment plan account owner portal. Open an account and start saving for college today. The maryland state treasurer, maryland. Locating your routing number and your account number. If there is a username for your account, we will send it to this email address. Decide exactly how you want to save with the maryland college investment plan (also referred to as the college investment plan), managed by t. The maryland state treasurer, maryland 529, mpct, intuition and their agents do. Rowe price, an investment management firm. Goldstein treasury building 80 calvert street annapolis, maryland 21401 usa. Open an account and start saving for college today. Decide exactly how you want to save with the maryland college investment plan (also referred to as the college investment plan), managed by t. Locating your routing number and your account number. If there is a username for your account, we will send it to this email address. Welcome to the maryland college investment plan account owner portal. The maryland state treasurer, maryland 529, mpct, intuition and their agents do not provide financial, legal or tax advice. Congress in 1996, and savings accounts used to fund specific expenses for eligible. To stay. The maryland 529 board administers qualified college tuition savings programs created by the u.s. If there is a username for your account, we will send it to this email address. To end your session, select the log off button, or take no action. Rowe price, an investment management firm. A state in which all people,. Welcome to the maryland college investment plan account owner portal. Rowe price, an investment management firm. Locating your routing number and your account number. Goldstein treasury building 80 calvert street annapolis, maryland 21401 usa. See the plans below to take advantage of the tax deduction available to maryland residents. See the plans below to take advantage of the tax deduction available to maryland residents. Manage your account anywhere, anytime. The maryland state treasurer, maryland 529, mpct, intuition and their agents do not provide financial, legal or tax advice. A state in which all people,. To stay logged in, select the continue button below. If this is your first time logging into your account since our transition to the new maryland college investment plan. A state in which all people,. The maryland state treasurer, maryland 529, mpct, intuition and their agents do not provide financial, legal or tax advice. Check your account balance, transaction history, and investment allocations. See the plans below to take. Goldstein treasury building 80 calvert street annapolis, maryland 21401 usa. Please enter your username and password. To stay logged in, select the continue button below. To end your session, select the log off button, or take no action. Open an account and start saving for college today. Learn answers to frequently asked questions and see how the plan can help you save for education expenses. Manage your account anywhere, anytime. If you've forgotten your password as well, you can reset it after receiving your username. Open an account and start saving for college today. Decide exactly how you want to save with the maryland college investment plan (also referred to as the college investment plan), managed by t. If there is a username for your account, we will send it to this email address. Goldstein treasury building 80 calvert street annapolis, maryland 21401 usa. To stay logged in, select the continue button below. Check your account balance, transaction history, and investment allocations. To end your session, select the log off button, or take no action. Locating your routing number and your account number. The maryland 529 board administers qualified college tuition savings programs created by the u.s. The maryland state treasurer, maryland 529, mpct, intuition and their agents do not provide financial, legal or tax advice. The maryland 529 plan tax deduction is a maryland state tax deduction you can receive for money you contribute to your maryland 529 college plan (savings and prepaid) in a. See the plans below to take advantage of the tax deduction available to maryland residents. Congress in 1996, and savings accounts used to fund specific expenses for eligible.529 Agudath Israel of Maryland

Maryland.gov MWEJobs Login⏬👇 How to Log into Maryland Workforce Exchange YouTube

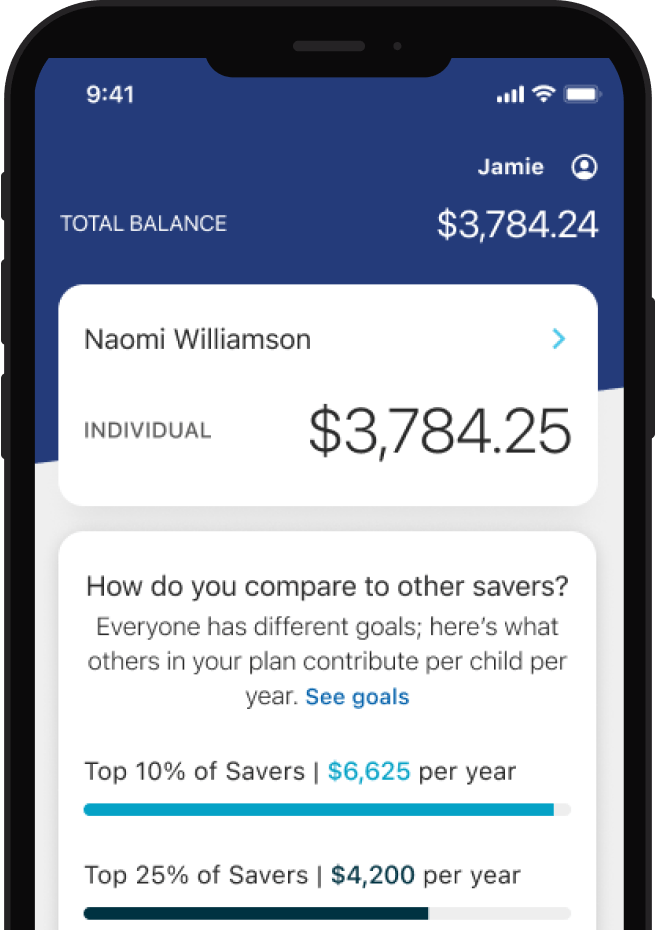

Invest in Their Future with Maryland 529

Maryland 529 plan calculation issue affects hundreds YouTube

Maryland 529

AL5GRJWGEJOWnTJ_19aqEPHqB0Bd8lShFiOrP1rzjc1v=s900ckc0x00ffffffnorj

Maryland 529 Plan Compass Advocacy Legal Services in MD

Addressing issues with Maryland 529 YouTube

Maryland 529 New Account Enrollment Form Enrollment Form

General Assembly hearing addresses issues with Maryland 529 College Savings Plan

Rowe Price, An Investment Management Firm.

A State In Which All People,.

Please Enter Your Username And Password.

If This Is Your First Time Logging Into Your Account Since Our Transition To The New Maryland College Investment Plan.

Related Post: